by on March 25, 2013

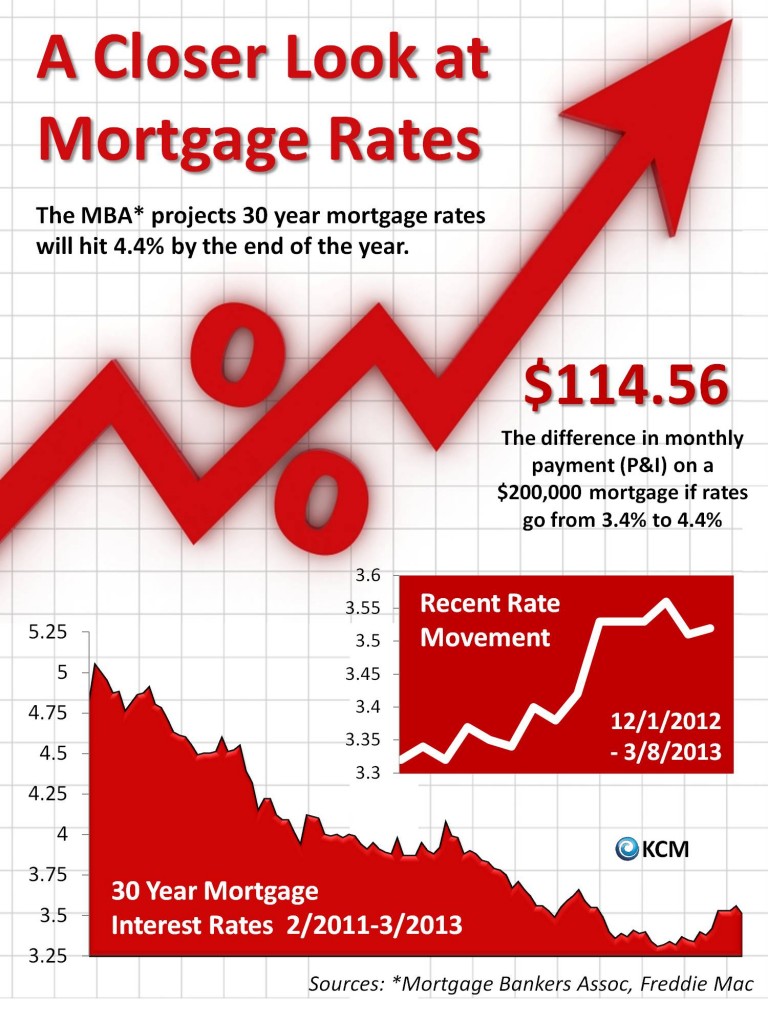

This week, we are going to look at the three financial reasons to buy a home now instead of waiting: prices are rising at an accelerated rate, interest rates are increasing and rents are skyrocketing. – The KCM Crew

Part I – Prices Are Rising at an Accelerated Rate

The price of a home is the major consideration when deciding whether or not it makes financial sense to purchase a house. Experts are not only projecting that house values will increase in 2013. They are also more optomistic in the level of appreciation they are projecting as the market begins to heat up. Here are some examples:

The price of a home is the major consideration when deciding whether or not it makes financial sense to purchase a house. Experts are not only projecting that house values will increase in 2013. They are also more optomistic in the level of appreciation they are projecting as the market begins to heat up. Here are some examples:

The Home Price Expectation Survey

The latest survey of a nationwide panel of 118 economists, real estate experts and investment and market strategists reveals they project home values to end 2013 up an average of 4.6% according to the first quarter. This is after they had projected a 3.1% increase just three months ago.

Bank of America

In a report titled, Someone Say House Party?, Bank of America analysts revised their projections upward:

“Home prices continue to show momentum amid shrinking inventory and record high affordability, prompting us to revise up our original forecast of 4.7% for home prices this year. We now expect national home prices, as defined by the S&P Case Shiller home price index, to increase 8% this year.”

Capital Economics

According to a report in DSNews, Capital Economics also upgraded their prediction:

“Strong demand and tight inventory have brought existing home sales back to ‘normal’ levels, and further gains are possible, according to the latest market report from Capital Economics. Additionally, market conditions may prompt lenders to “loosen the purse strings slightly” and lend a little more freely.

These conditions, combined with broader economic indicators, lead Capital Economics to revise its previous forecast of a 5% price gain this year up to 8%.”

Morgan Stanley

In an article from HousingWire, Morgan Stanley joined the party:

“Strong momentum in home prices as well as housing activity gave Morgan Stanley analysts enough confidence to upgrade their home price appreciation projections to roughly 7% (from 5%) for 2013, according to its latest global securitized credit report…

“The momentum in most metrics of housing activity is running well ahead of the pace we had expected,” said James Egan, Jose Cambronero and Vishwanath Tirupattur, analysts for Morgan Stanley.”

Not only are prices projected to appreciate. Experts are actually revising their projections upward as demand maintains its momentum.

Tomorrow, we will look at increasing interest rates.

http://www.kcmblog.com/2013/03/25/3-financial-reasons-to-buy-a-home-now-part-i/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+KeepingCurrentMatters+%28The+KCM+Blog%29

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link